CK3 and CK2 I have hundred of hours into and counting. Try RimWorld as well if you haven't.Any gamers that can recommend a XXXX/Grand Strategy game? Paradox sale going on thru Steam. Closest I’ve ever come to the genre is Age of Empires.

Interested in stellaris, CK3, EU4, and HOI4. Seems like the DLC is basically required in some cases.

OT: The Off-Topic Thread sponsored by Hank Scorpio

- Thread starter Winger98

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Any gamers that can recommend a XXXX/Grand Strategy game? Paradox sale going on thru Steam. Closest I’ve ever come to the genre is Age of Empires.

Interested in stellaris, CK3, EU4, and HOI4. Seems like the DLC is basically required in some cases.

Haven't really dipped my toe into that pool yet. So I have no specific recommendations.

However if you want to try some stuff out on the cheap, Crusader Kings 3 (and a bunch of other strategy games) is on Xbox game pass for PC. So is Age of Empires 4.

I really enjoy the game pass because it lets me try it and drop games pretty regularly that I'd never usually buy at full asking price. Sorta like Netflix. I wouldn't have paid extra to rent/buy Godless but I'm really happy I did get to see it.

RayMoonDoh

Outta Waiver Stuff

Leaning CK3, looking into RimWorld too. Thanks for taking the time to offer your thoughts!CK3 and CK2 I have hundred of hours into and counting. Try RimWorld as well if you haven't.

RayMoonDoh

Outta Waiver Stuff

Thanks for your reply! Need to finish up my hardware project so I can try it out. Will have to see if buying CK3 on steam at 20% off vs GP is the better optionHaven't really dipped my toe into that pool yet. So I have no specific recommendations.

However if you want to try some stuff out on the cheap, Crusader Kings 3 (and a bunch of other strategy games) is on Xbox game pass for PC. So is Age of Empires 4.

I really enjoy the game pass because it lets me try it and drop games pretty regularly that I'd never usually buy at full asking price. Sorta like Netflix. I wouldn't have paid extra to rent/buy Godless but I'm really happy I did get to see it.

Ricelund

̶W̶e̶ ̶l̶i̶k̶e̶ ̶o̶u̶r̶ ̶t̶e̶a̶m̶

@Bench - what mode should I be playing Hunt in?

Start with the three tutorials to get your feet wet. After you feel comfortable with the basic rules and the controls you're in for a baptism by fire in either bounty hunt or quick play.

Bounty hunt is the "real" version of the game. As it was intended. You'll need to invite a friend or two or you can play with random duos or trios.

Quick play is more casual and more like a traditional battle royal. Every man for themselves. Random weapons.

There's so much to explain it's a bit overwhelming at first. We can either run a few missions together and/or you'll want to hit up a few guides on YouTube.

MabusIncarnate

Registered User

Godless was really good, probably my favorite since Deadwood.Haven't really dipped my toe into that pool yet. So I have no specific recommendations.

However if you want to try some stuff out on the cheap, Crusader Kings 3 (and a bunch of other strategy games) is on Xbox game pass for PC. So is Age of Empires 4.

I really enjoy the game pass because it lets me try it and drop games pretty regularly that I'd never usually buy at full asking price. Sorta like Netflix. I wouldn't have paid extra to rent/buy Godless but I'm really happy I did get to see it.

I like RTS a lot, but i'm just a console guy now so I don't play much outside of Halo Wars 2 here and there. Been into the Halo Infinite campaign which is cool so far, and playing stuff like Guardians of the Galaxy, Orcs Must Die 3, and Hades on the side. I bounce around a lot with what I play.

Godless was really good, probably my favorite since Deadwood.

Hell yeah. Jeff Daniels was great as the villain. He pulled me into that story.

Deadwood is one of my favorites. I really enjoyed the recent movie HBO did too. It was a nice return to all those memorable characters.

FabricDetails

HF still in need of automated text analytics

- Mar 30, 2009

- 8,163

- 3,920

I'm kicking around the idea of hiring a financial advisor but at the same time I appreciate how I should try to understand as much as possible why they make the moves they do.

In regard to trying to understand the why, how would y'all best go about that if you're brand new to that world? A series of classes?

In regard to trying to understand the why, how would y'all best go about that if you're brand new to that world? A series of classes?

Ricelund

̶W̶e̶ ̶l̶i̶k̶e̶ ̶o̶u̶r̶ ̶t̶e̶a̶m̶

I highly, highly recommend looking into the "Bogleheads" approach to personal finance/investing. Here are some good resources:I'm kicking around the idea of hiring a financial advisor but at the same time I appreciate how I should try to understand as much as possible why they make the moves they do.

In regard to trying to understand the why, how would y'all best go about that if you're brand new to that world? A series of classes?

- If You Can: How Millennials Can Get Rich Slowly – William J. Bernstein

- The Little Book of Common Sense Investing – John C. Bogle

- How a Second Grader Beats Wall Street: Golden Rules Any Investor Can Learn – Allan S. Roth

- The Bogleheads’ Guide to Investing – Taylor Larimore, Mel Lindauer, and Michael LeBoeuf

- Bogleheads Wiki

- Bogleheads Subreddit

In short, you want to majorly diversify your investments and avoid fees as much as possible. Most financial advisors charge 0.5-1.0% per year to manage your money, meaning if you have $100,000 invested with them, they charge $500-1,000 per year. The dollar value of these percentage fees increase over time as the value of the portfolio grows. This doesn't sound like much but over time it adds up to a ton of money. On top of this, advisors will often put you into funds that charge fees (expense ratios) every year. These really add up over time. They'll also often charge various fees such as setup fees for new clients.

Looking at this example in practice, let's say you invest $100,000 and keep it invested for 30 years at a 6% rate of return. Your advisor charges 1% per year to manage your portfolio. This adds up to almost $145k in the advisor's management fees alone over 30 years. Add in whatever other fees the advisor charges along with the expense ratios of the funds they put you in.

So, what's the best course of action? First, you'll want to set an asset allocation you're comfortable with between stocks and bonds. If you're looking for high risk/high reward, you'll weight more heavily towards stocks. If you're looking for less risk/reward, you'll weight more heavily towards stocks. Personally, I'm in 90% stocks and 10% bonds. This is a personal decision and you have to take some time to decide what's right for you. Also, set up an emergency fund in a savings account with 3-6 months worth of expenses in it should you need cash.

Once you've decided on an asset allocation, invest in the entire market. Don't bother trying to pick individual stocks, sector-weighted funds, cryptocurrency, or other actively managed funds. Just buy simple, low-cost passive funds like VTI (Vanguard Total Stock Market ETF) and BND (Vanguard Total Bond Market ETF). These are extremely low cost to own (VTI is 0.03% per year) and basically just track the performance of the entire stock/bond markets. If you really need to scratch the itch of gambling on individual stocks or crypto, maybe allocate 1-2% of your portfolio to doing this.

Over a long enough timeline, it's extremely difficult for active fund managers to beat average market performance. When you reduce your returns with the fees they charge, it's almost never worth it. You can read Warren Buffett's take on this here: Buffett's Bet with the Hedge Funds: And the Winner Is …

All of this depends on your personal situation so do proceed with caution and do your research, but the Bogleheads approach is tried and true. I'm really interested in this stuff so let me know if you have any questions.

Last edited:

TCNorthstars

Registered User

I highly, highly recommend looking into the "Bogleheads" approach to personal finance/investing. Here are some good resources:

John Bogle founded Vanguard and created the first index fund. He's developed a huge following for his simplistic approach to investing and has saved average investors literally billions of dollars that would've otherwise gone to fund managers/advisors/etc.

- If You Can: How Millennials Can Get Rich Slowly – William J. Bernstein

- The Little Book of Common Sense Investing – John C. Bogle

- How a Second Grader Beats Wall Street: Golden Rules Any Investor Can Learn – Allan S. Roth

- The Bogleheads’ Guide to Investing – Taylor Larimore, Mel Lindauer, and Michael LeBoeuf

- Bogleheads Wiki

- Bogleheads Subreddit

In short, you want to majorly diversify your investments and avoid fees as much as possible. Most financial advisors charge 0.5-1.0% per year to manage your money, meaning if you have $100,000 invested with them, they charge $500-1,000 per year. These fees increase over time as the value of the portfolio grows. This doesn't sound like much but over time it adds up to a ton of money. On top of this, advisors will often put you into funds that charge fees (expense ratios) every year. These really add up over time. They'll also often charge various one-time setup fees for new clients.

Looking at this example in practice, let's say you invest $100,000 and keep it invested for 30 years at a 6% rate of return. Your advisor charges 1% per year to manage your portfolio. This adds up to almost $145k in fees alone over 30 years.

So, what's the best course of action? First, you'll want to set an asset allocation you're comfortable with between stocks and bonds. If you're looking for high risk/high reward, you'll weight more heavily towards stocks. If you're looking for less risk/reward, you'll weight more heavily towards stocks. Personally, I'm in 90% stocks and 10% bonds. This is a personal decision and you have to take some time to decide what's right for you.

Once you've decided on an asset allocation, invest in the entire market. Don't bother trying to pick individual stocks, sector-weighted funds, or other actively managed funds. Just buy simple, low-cost passive funds like VTI (Vanguard Total Stock Market ETF) and BND (Vanguard Total Bond Market ETF). These are extremely low cost to own (VTI is 0.03% per year) and basically just track the performance of the entire stock/bond markets.

Over a long enough timeline, it's extremely difficult for active fund managers to beat average market performance. When you reduce your returns with the fees they charge, it's almost never worth it. You can read Warren Buffett's take on this here: Buffett's Bet with the Hedge Funds: And the Winner Is …

All of this depends on your personal situation so do proceed with caution and do your research, but the Bogleheads approach is tried and true. I'm really interested in this stuff so let me know if you have any questions.

This is pretty sound advice, IMO. You shouldn't need financial advisor until you are a millionaire or so. Spend your money on an estate attorney.

Super not true. I've had the same financial advisor from when I was making $40K a year. If you have 5K or more in your checking/saving account, you should get a financial advisor. If you have 1-2K in your accounts, it wouldn't be a bad idea to get one.This is pretty sound advice, IMO. You shouldn't need financial advisor until you are a millionaire or so. Spend your money on an estate attorney.

I was putting in like $100 a month into my investment accounts when I first got my guy. The ROI you could see is pretty neat. That ROI helped pay for X-Mas presents and plane tickets this year and I am no where near a millionaire.

TCNorthstars

Registered User

Super not true. I've had the same financial advisor from when I was making $40K a year. If you have 5K or more in your checking/saving account, you should get a financial advisor. If you have 1-2K in your accounts, it wouldn't be a bad idea to get one.

I was putting in like $100 a month into my investment accounts when I first got my guy. The ROI you could see is pretty neat. That ROI helped pay for X-Mas presents and plane tickets this year and I am no where near a millionaire.

Your guy didn’t do anything you couldn’t have done yourself doing what Ricelund was talking about. He just charged you more to do it.

5k in saving isn’t a lot. Especially for an emergency fund.

Your financial portfolio is easy to manage on your own. You need the advisor when your stuff gets complex with many different investment vehicles and a lot of money to manage.

Agree to disagree. I could fix my car myself if I learned enough about it, but I'd rather pay the mechanic to fix it.Your guy didn’t do anything you couldn’t have done yourself doing what Ricelund was talking about. He just charged you more to do it.

5k in saving isn’t a lot. Especially for an emergency fund.

Your financial portfolio is easy to manage on your own. You need the advisor when your stuff gets complex with many different investment vehicles and a lot of money to manage.

I'd be shocked if 90% of this board doesn't have $5K in their savings. Maybe it's just me, but I like the idea of never having to worry about managing my portfolios. I invest X% of my paycheck to my financial guy and he turns that into more money, doesn't bother me the slightest that his services are more than free. Just like the mechanic, I let the professional people do it and don't have to spend a minute worrying about it.

Lil Sebastian Cossa

Opinions are share are my own personal opinions.

- Jul 6, 2012

- 11,436

- 7,446

Agree to disagree. I could fix my car myself if I learned enough about it, but I'd rather pay the mechanic to fix it.

I'd be shocked if 90% of this board doesn't have $5K in their savings. Maybe it's just me, but I like the idea of never having to worry about managing my portfolios. I invest X% of my paycheck to my financial guy and he turns that into more money, doesn't bother me the slightest that his services are more than free. Just like the mechanic, I let the professional people do it and don't have to spend a minute worrying about it.

the fee is worth it for you.

the fee isn’t worth it for other people.

It’s the same as buying a prebuilt PC vs making your own. You can make your own better and cheaper (usually) and a prebuilt can have some really crappy internals. However, if you’re just going to pay basic games and/or do internet/email/word processing… that could be fine for you.

Konnan doesn’t have to consider for a second about how it’s invested. If that peace of mind is worth 500 a year? Knock yourself out!

MabusIncarnate

Registered User

If anyone is into the Star Wars stuff, that Boba Fett show premieres tonight at 3am on Disney +

It's supposed to be about the same tone as Mandalorian from what I gather.

It's supposed to be about the same tone as Mandalorian from what I gather.

jaster

Take me off ignore, please.

- Jun 8, 2007

- 13,301

- 8,547

If anyone is into the Star Wars stuff, that Boba Fett show premieres tonight at 3am on Disney +

It's supposed to be about the same tone as Mandalorian from what I gather.

Can't wait for it. I don't want to disclose exactly how much of a Star Wars nerd I am, and I'm surprised no one has ever said anything to me on these Wings forums, but..... my handle. It's not only Star Wars related, but it's deeply tied to the history of Boba Fett.

Damn it, I think I kinda just disclosed how much of a Star Wars nerd I am. Anyway, I'm not sure even Wookieepedia goes into this much detail, but before this current era, way before the prequels, and even the special editions.... back in the 90s, in the wake of Timothy Zahn's iconic Thrawn trilogy.... Jaster Mereel was believed to be Boba Fett's real name. That lore was later fleshed out and Jaster Mereel became a separate character altogether. But back when I began using the handle on the early internet, it was Boba Fett's "true" identity

Ricelund

̶W̶e̶ ̶l̶i̶k̶e̶ ̶o̶u̶r̶ ̶t̶e̶a̶m̶

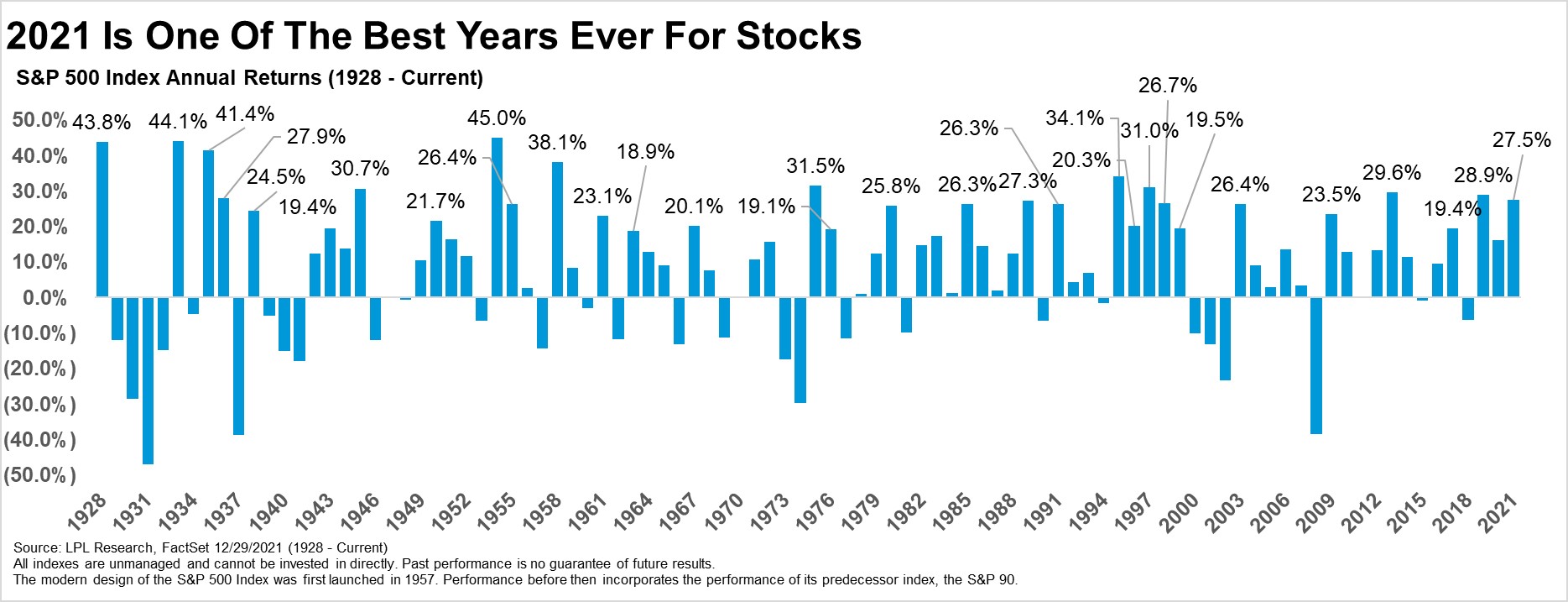

To each their own. The truth is, it would've been difficult to NOT make really good money in the market over the past several years. The S&P 500 is up 27.5% this year alone:Super not true. I've had the same financial advisor from when I was making $40K a year. If you have 5K or more in your checking/saving account, you should get a financial advisor. If you have 1-2K in your accounts, it wouldn't be a bad idea to get one.

I was putting in like $100 a month into my investment accounts when I first got my guy. The ROI you could see is pretty neat. That ROI helped pay for X-Mas presents and plane tickets this year and I am no where near a millionaire.

Just be sure you're aware of what your advisor is charging you and the expense ratios of the funds he has you in and factor those costs into your returns vs. just putting your money in a broad index fund.

Last edited:

RayMoonDoh

Outta Waiver Stuff

I’m way sucked into CK3. Thanks again for the Recs!CK3 and CK2 I have hundred of hours into and counting. Try RimWorld as well if you haven't.

RayMoonDoh

Outta Waiver Stuff

Game pass is awesome, there goes my semester break!Haven't really dipped my toe into that pool yet. So I have no specific recommendations.

However if you want to try some stuff out on the cheap, Crusader Kings 3 (and a bunch of other strategy games) is on Xbox game pass for PC. So is Age of Empires 4.

I really enjoy the game pass because it lets me try it and drop games pretty regularly that I'd never usually buy at full asking price. Sorta like Netflix. I wouldn't have paid extra to rent/buy Godless but I'm really happy I did get to see it.

cjm502

Bingo Bango!

CK3 is fun, I spent so much time perfecting my moves throughout the first few years to set myself up for success later down the road. There are also tons of cool mods for that game. I enjoyed using mods to create a starting character with every desirable inheritable trait possible and have the best bloodlines on the planet lolI’m way sucked into CK3. Thanks again for the Recs!

FabricDetails

HF still in need of automated text analytics

- Mar 30, 2009

- 8,163

- 3,920

I highly, highly recommend looking into the "Bogleheads" approach to personal finance/investing. Here are some good resources:

John Bogle founded Vanguard and created the first index fund. He's developed a huge following for his simplistic approach to investing and has saved average investors literally hundreds of billions (probably trillions) of dollars that would've otherwise gone to fund managers/advisors/etc.

- If You Can: How Millennials Can Get Rich Slowly – William J. Bernstein

- The Little Book of Common Sense Investing – John C. Bogle

- How a Second Grader Beats Wall Street: Golden Rules Any Investor Can Learn – Allan S. Roth

- The Bogleheads’ Guide to Investing – Taylor Larimore, Mel Lindauer, and Michael LeBoeuf

- Bogleheads Wiki

- Bogleheads Subreddit

In short, you want to majorly diversify your investments and avoid fees as much as possible. Most financial advisors charge 0.5-1.0% per year to manage your money, meaning if you have $100,000 invested with them, they charge $500-1,000 per year. The dollar value of these percentage fees increase over time as the value of the portfolio grows. This doesn't sound like much but over time it adds up to a ton of money. On top of this, advisors will often put you into funds that charge fees (expense ratios) every year. These really add up over time. They'll also often charge various fees such as setup fees for new clients.

Looking at this example in practice, let's say you invest $100,000 and keep it invested for 30 years at a 6% rate of return. Your advisor charges 1% per year to manage your portfolio. This adds up to almost $145k in the advisor's management fees alone over 30 years. Add in whatever other fees the advisor charges along with the expense ratios of the funds they put you in.

So, what's the best course of action? First, you'll want to set an asset allocation you're comfortable with between stocks and bonds. If you're looking for high risk/high reward, you'll weight more heavily towards stocks. If you're looking for less risk/reward, you'll weight more heavily towards stocks. Personally, I'm in 90% stocks and 10% bonds. This is a personal decision and you have to take some time to decide what's right for you. Also, set up an emergency fund in a savings account with 3-6 months worth of expenses in it should you need cash.

Once you've decided on an asset allocation, invest in the entire market. Don't bother trying to pick individual stocks, sector-weighted funds, cryptocurrency, or other actively managed funds. Just buy simple, low-cost passive funds like VTI (Vanguard Total Stock Market ETF) and BND (Vanguard Total Bond Market ETF). These are extremely low cost to own (VTI is 0.03% per year) and basically just track the performance of the entire stock/bond markets. If you really need to scratch the itch of gambling on individual stocks or crypto, maybe allocate 1-2% of your portfolio to doing this.

Over a long enough timeline, it's extremely difficult for active fund managers to beat average market performance. When you reduce your returns with the fees they charge, it's almost never worth it. You can read Warren Buffett's take on this here: Buffett's Bet with the Hedge Funds: And the Winner Is …

All of this depends on your personal situation so do proceed with caution and do your research, but the Bogleheads approach is tried and true. I'm really interested in this stuff so let me know if you have any questions.

So... I feel like I don't understand what any of these words mean. But I definitely appreciate the take and I'll try and struggle with it as much as I can.

Game pass is awesome, there goes my semester break!

Yeah I try not to be a shill but if you play even 3-4 games a year on it, it kinda pays for itself.

But it's also a good way to "rent" a few games and try them out for a month. Back in the day I used to rent so many games because they were fun for like a week but not for $60. This has finally brought that experience back for me.

cjm502

Bingo Bango!

With game pass being only $1 for the first 3 months right now, you can't beat it. I purchased my game pass a month or two ago for FH5 and was surprised at how many top tier titles were available.Yeah I try not to be a shill but if you play even 3-4 games a year on it, it kinda pays for itself.

But it's also a good way to "rent" a few games and try them out for a month. Back in the day I used to rent so many games because they were fun for like a week but not for $60. This has finally brought that experience back for me.

MabusIncarnate

Registered User

First episode was real good jaster, if you haven't watched it yet, you will be happy.

Also for Game Pass users, Spiritfarer is on there and I highly recommend it. It may have been my favorite game of 2020.

Also for Game Pass users, Spiritfarer is on there and I highly recommend it. It may have been my favorite game of 2020.

- Status

- Not open for further replies.

Ad

Upcoming events

-

-

-

Game 4 Boston Celtics @ Indiana Pacers - Boston leads series 3-0Wagers: 2Staked: $2,357.00Event closes

Game 4 Boston Celtics @ Indiana Pacers - Boston leads series 3-0Wagers: 2Staked: $2,357.00Event closes- Updated:

-

-

Game 3 Dallas Stars @ Edmonton Oilers - Series tied 1-1Wagers: 13Staked: $17,222.00Event closes

Game 3 Dallas Stars @ Edmonton Oilers - Series tied 1-1Wagers: 13Staked: $17,222.00Event closes- Updated: