NorthCoast

Registered User

- May 1, 2017

- 1,250

- 1,167

How much of an impact on real cap dollars are front-loaded bonus laden contracts having?

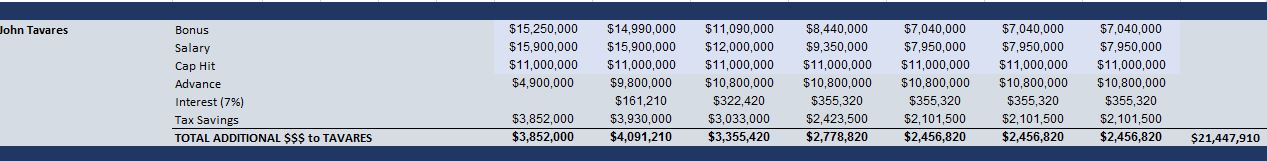

This question came up in respects to the value of a front-loaded contract for Karlsson from SJ vs a non-front-loaded contract from Ott. It was an interesting deep dive and so I have expanded the research to look at the impact of these contracts on the capitals for the business forum.

How do Front-Loaded Contracts Impact Cap

1) Taxes. In most states salary that is considered "bonus" is taxed at a lower rate than normal income. In Washington DC, the first million of bonus is taxed at 25% vs. 37% for normal income tax.

2) Interest. Assuming that a player invests any advances (salary paid above cap hit), and receives a standard 7% return from the markets, then they will benefit from interest that they would not have received had the salary matched their yearly cap hit.

Should the extra money players receive from the above be considered additional cap dollars?

For sure this is a bit of an over simplification, but I though it was worth discussing because if a team took this practice to the extreme (every player paid in bonus with front-loaded structure) then it could have a pretty significant impact on actual cap dollars to spend.

Below I attempted to draw out the implication for the Caps based on the players that have these contracts in place. Using this method it would appear as if the caps will get an additional 14.6 million in cap over the next 7 years, or about 2.1 extra per year.

Capture — Postimage.org

I imagine that there are errors in the methodology so please feel free to provide feedback on the semantics, but regardless of the exact percentages, I can't imagine it not having an impact.

Thoughts?

This question came up in respects to the value of a front-loaded contract for Karlsson from SJ vs a non-front-loaded contract from Ott. It was an interesting deep dive and so I have expanded the research to look at the impact of these contracts on the capitals for the business forum.

How do Front-Loaded Contracts Impact Cap

1) Taxes. In most states salary that is considered "bonus" is taxed at a lower rate than normal income. In Washington DC, the first million of bonus is taxed at 25% vs. 37% for normal income tax.

2) Interest. Assuming that a player invests any advances (salary paid above cap hit), and receives a standard 7% return from the markets, then they will benefit from interest that they would not have received had the salary matched their yearly cap hit.

Should the extra money players receive from the above be considered additional cap dollars?

For sure this is a bit of an over simplification, but I though it was worth discussing because if a team took this practice to the extreme (every player paid in bonus with front-loaded structure) then it could have a pretty significant impact on actual cap dollars to spend.

Below I attempted to draw out the implication for the Caps based on the players that have these contracts in place. Using this method it would appear as if the caps will get an additional 14.6 million in cap over the next 7 years, or about 2.1 extra per year.

Capture — Postimage.org

I imagine that there are errors in the methodology so please feel free to provide feedback on the semantics, but regardless of the exact percentages, I can't imagine it not having an impact.

Thoughts?

Last edited: